Table of Contents

- Introduction: Why Housing Financing Matters

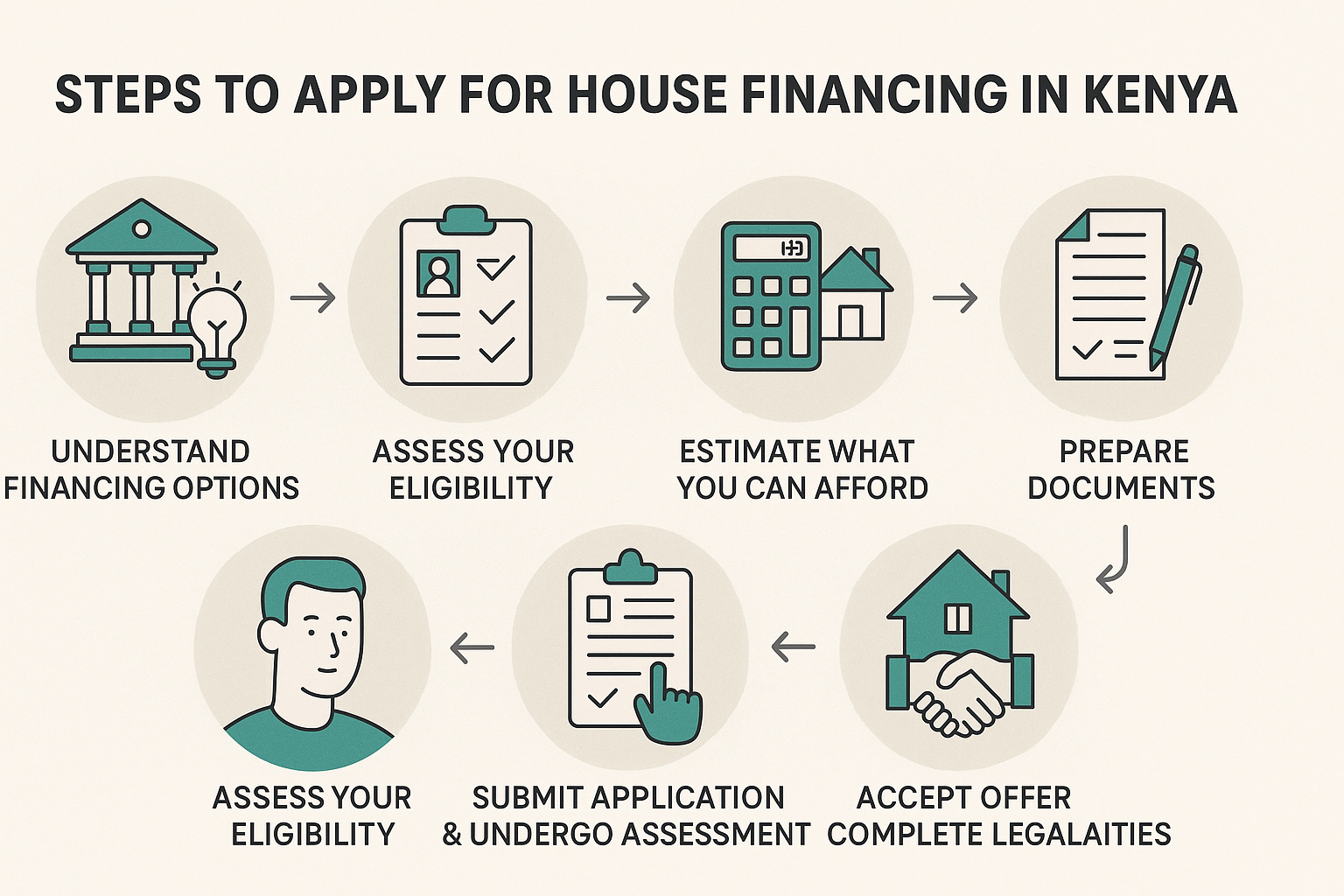

- Understanding the Types of Housing Financing Options in Kenya

- Types of Mortgages Available

- Assessing Your Eligibility (What Lenders Look At)

- Estimating What You Can Afford

- Preparing All Necessary Documents

- Submitting Your Application & Undergoing Assessment

- Accepting the Offer, Legal / Conveyancing Process & Documentation

- Disbursement of Funds & Loan Repayment

- Costs, Fees & Other Financial Considerations

- Timeline: How Long It Takes

- Common Pitfalls & How to Avoid Them

- Tips for a Smooth Application & Better Terms

- Case Study / Example (Illustrative)

- After You Move In: Managing Your Mortgage

- Final Remarks & Next Steps

Introduction: Why Housing Financing Matters

For most Kenyans, buying a home outright with cash is unrealistic given the ever-rising land and property prices in urban areas like Nairobi, Mombasa, and Kisumu. Mortgages and other financing options make homeownership more accessible by allowing buyers to spread payments over several years, sometimes decades.

However, many potential homeowners hesitate because they find the process complicated, worry about high interest rates, or fear hidden charges. Understanding the entire journey—from choosing a financing option to signing your mortgage documents—helps you make informed decisions and avoid common mistakes.

Think of mortgage financing as a partnership: you bring part of the funds (the deposit or down payment), and the lender supports you with the rest. Your responsibility is to service the loan consistently until it’s cleared. When done wisely, a mortgage can unlock your dream of owning a safe, permanent home without waiting decades to save cash upfront.

Understanding the Types of Housing Financing Options in Kenya

When people hear “house financing,” most immediately think of bank mortgages. While banks dominate the space, there are multiple other financing avenues you can explore:

- Commercial Bank Mortgages – These are structured long-term loans with fixed or flexible interest rates. Banks often finance up to 90% of the property’s value, with repayment periods ranging from 10 to 25 years.

- SACCO and Cooperative Loans – Popular among teachers, police officers, and civil servants, SACCOs often provide housing loans at lower rates than banks. Unlike banks, SACCOs may be more flexible if you’re already a long-standing member with savings.

- Chama and Group Lending – Community savings groups sometimes pool funds to support members in acquiring plots or building homes. While smaller in scale, this option offers community support and reduced interest.

- Employer Housing Schemes – Some large organizations, especially parastatals, provide subsidized housing loans or guarantee employees’ mortgages.

- Pension-Backed Loans – Thanks to retirement benefit regulations, you can now use part of your pension savings as collateral for a housing loan, making it easier to access financing.

- Microfinance Institutions – Some MFIs cater to low- and middle-income earners, offering construction loans or incremental building finance.

- Construction Loans – If your plan is to build rather than buy, construction loans disburse money in phases aligned with building progress.

Each option has advantages and limitations. For instance, SACCO loans are cheaper but may have lower lending limits, while banks can lend higher amounts but often come with stricter conditions.

Types of Mortgages Available

Not all mortgages are structured the same. When you apply, it’s crucial to know what kind of product best fits your financial situation.

- Fixed-Rate Mortgages: You lock in an interest rate for the entire repayment period. Payments remain consistent, helping you budget long-term. The downside is you won’t benefit if rates drop.

- Adjustable-Rate Mortgages (ARMs): Your interest rate changes over time, usually tied to Central Bank rates. This could mean lower payments initially, but rising rates could increase your monthly instalments later.

- Reducing Balance Mortgages: Interest is calculated only on the outstanding balance rather than the original loan amount, making repayments reduce over time.

- Interest-Only Mortgages: In the early years, you pay only the interest before starting principal repayments. This keeps initial payments lower but requires discipline to handle future higher instalments.

- Diaspora Mortgages: Tailored for Kenyans abroad, these products allow you to invest back home while earning in foreign currency.

- Affordable Housing Mortgages: Linked to government-backed affordable housing schemes, they target middle- and low-income earners with special rates.

The type of mortgage you choose will affect your repayment comfort. For risk-averse borrowers, fixed-rate loans are best, while those expecting income growth may opt for adjustable or construction-linked mortgages.

Assessing Your Eligibility (What Lenders Look At)

Mortgage lenders want assurance that you can repay consistently. Here are the top factors they evaluate:

- Income Stability – Banks want to see a steady income stream. For employees, this means at least 3–6 months’ payslips and bank statements. For business owners, audited accounts over 2 years may be required.

- Credit History – Your CRB (Credit Reference Bureau) record plays a huge role. A history of default or late payments can harm your chances.

- Debt-to-Income Ratio – This measures how much of your income is already committed to existing loans. Ideally, no more than 40% of your net income should go into debt servicing.

- Down Payment (Deposit) – Most lenders expect at least 10–30% of the property’s value upfront. This demonstrates your commitment and reduces the bank’s risk.

- Property Value and Title Status – The property must be legally sound, with a clean title deed and no disputes.

- Age and Retirement Factor – Mortgages typically extend only up to retirement age. For example, if you are 45, you may qualify only for a 15-year loan instead of 25 years.

Estimating What You Can Afford

It’s tempting to target your dream house right away, but lenders—and your financial health—require realism.

- Use Mortgage Calculators: Simulate monthly repayments under different interest rates and loan amounts.

- Factor in Lifestyle Costs: School fees, medical cover, transport, and emergencies must remain affordable after you commit to a mortgage.

- Rule of Thumb: Housing costs (rent or mortgage) should not exceed 30–35% of your net income.

- Interest Rate Risk: For variable loans, always test scenarios with 2–3% higher rates to ensure you can still cope.

- Avoid Overcommitting: Start with a manageable house and consider upgrading later as your income grows.

Preparing All Necessary Documents

Strong documentation speeds up approvals. A typical checklist includes:

For Salaried Employees:

- Payslips for the last 3 months

- Bank statements (6–12 months)

- Employment letter or contract

- Copy of national ID and KRA PIN

- Passport-size photos

- Sale agreement and property details

For Self-Employed Individuals:

- Audited financial statements (last 2 years)

- Tax compliance certificate

- Business registration documents

- 12 months’ bank statements

- Personal ID and PIN

For All Applicants:

- Clean title deed of the property

- Valuation report (by approved valuer)

- Insurance cover (life and property)

Missing or inconsistent paperwork is one of the biggest reasons for delays. Prepare in advance to avoid setbacks.

Submitting Your Application & Undergoing Assessment

Once your documents are ready, you move into the formal application stage:

- Application Form – Complete the bank’s mortgage form carefully.

- Initial Review – The bank screens your eligibility based on income, debts, and documentation.

- Property Valuation – A registered valuer inspects the house or land to confirm its market worth. You pay for this valuation.

- Credit Appraisal – The bank’s credit team analyzes your repayment ability, CRB record, and property documents.

- Offer Letter – If approved, you receive a mortgage offer detailing loan amount, rate, tenure, repayment structure, and conditions.

Accepting the Offer, Legal / Conveyancing Process & Documentation

This stage involves several legal and financial steps:

- Accepting the Offer: Sign and return the offer within the given timeframe.

- Engage Lawyers: The bank or your lawyer facilitates property transfer and registration.

- Title Registration: The property is transferred to your name, and the bank registers a charge (mortgage) against it.

- Stamp Duty and Legal Fees: Typically 4% of the property value (for urban areas).

- Insurance Policies: Mortgage protection and property insurance must be in place before disbursement.

Disbursement of Funds & Loan Repayment

- Disbursement: After all legal conditions are met, the bank releases funds directly to the seller or contractor. For construction loans, money is released in tranches as work progresses.

- Loan Repayment: Repayment begins about a month after disbursement. Repayments include both interest and principal. Missing payments can lead to penalties or even foreclosure.

Costs, Fees & Other Financial Considerations

Besides the deposit, budget for these additional costs:

- Valuation fees (0.25–1% of property value)

- Stamp duty (approx. 4% in cities, 2% in rural areas)

- Legal and conveyancing fees (varies by lawyer and lender)

- Mortgage protection insurance premiums

- Processing or appraisal fees (about 2% of loan amount in some banks)

- Miscellaneous administrative charges

Altogether, expect to add an extra 5–10% of the property’s value to cover these expenses.

Timeline: How Long It Takes

While timelines vary, the mortgage process generally follows this path:

- Document submission: 1 week

- Prequalification: 1–2 weeks

- Valuation: 1 week

- Credit approval: 1–2 weeks

- Legal and registration: 3–6 weeks

- Disbursement: 1–2 weeks

Total: 6–10 weeks, depending on efficiency of the bank and property documentation.

Common Pitfalls & How to Avoid Them

- Submitting incomplete paperwork

- Choosing property with defective titles

- Underestimating hidden costs

- Borrowing beyond your capacity

- Ignoring variable rate risks

- Signing sale agreements before loan approval

Tips for a Smooth Application & Better Terms

- Start saving early for a bigger deposit.

- Clear small debts before applying.

- Maintain good CRB standing.

- Shop around: compare multiple banks before deciding.

- Negotiate: ask about waivers on processing fees or insurance bundling.

- Consider a SACCO if you want lower interest rates.

Case Study / Example (Illustrative)

Imagine Jane, a 35-year-old professional earning Ksh 250,000 per month. She wants to buy a house worth Ksh 10 million.

- Down payment: 20% = Ksh 2M

- Loan required: Ksh 8M

- Tenure: 20 years at 11% fixed interest

Her monthly repayment comes to about Ksh 87,000. This is within her 40% debt-to-income ratio, making her eligible. However, she must also prepare Ksh 600,000 for legal fees, stamp duty, and insurance.

After You Move In: Managing Your Mortgage

- Set up standing orders for repayments to avoid missed instalments.

- Monitor your mortgage statement regularly.

- Consider making lump-sum repayments if you receive bonuses or windfalls.

- Maintain property insurance and update coverage as needed.

- Stay in touch with your lender in case of financial difficulties—many offer restructuring options.

Final Remarks & Next Steps

Buying a house in Kenya is a rewarding but complex journey. By understanding financing options, preparing the right documents, and carefully managing your loan, you can turn homeownership into reality without financial strain.

Action Plan for You:

- Assess your financial readiness.

- Research at least 3 lenders for comparison.

- Save for a deposit and additional costs.

- Prepare documents early.

- Seek professional advice (lawyer, financial advisor) where needed.

Homeownership is within reach—start planning today.

FAQs on House Financing in Kenya

1. What is the minimum deposit required for a mortgage in Kenya?

Most lenders require between 10% and 30% of the property’s value as a deposit. The exact percentage depends on the bank, the type of mortgage, and your risk profile. A larger deposit not only improves your chances of approval but may also earn you lower interest rates.

2. How long can I repay a mortgage in Kenya?

Mortgage tenures usually range from 5 to 25 years. However, the repayment period is often limited by your age. Many lenders require the loan to be fully repaid by the time you reach retirement age, typically 60–65 years.

3. Can self-employed people qualify for a mortgage?

Yes, but the requirements are stricter. You will need audited financial statements for at least two years, bank statements, tax compliance certificates, and proof of steady business income. Lenders want assurance that your income is sustainable.

4. What happens if I default on my mortgage payments?

If you miss payments, the bank will first issue reminders and apply penalties. Persistent default may lead to foreclosure, where the lender repossesses and sells the property to recover the loan balance. It’s always advisable to engage your lender early if you face financial difficulties—some offer restructuring options.

5. Are SACCO housing loans better than bank mortgages?

It depends on your needs. SACCOs generally offer lower interest rates and simpler processes, but loan amounts may be smaller and limited to members. Banks offer higher amounts, longer tenures, and a variety of mortgage products but with stricter conditions and slightly higher costs.

6. Do I need insurance when taking a mortgage?

Yes. Most lenders require mortgage protection insurance (to cover the loan in case of death or disability) and property insurance (to protect the house against risks such as fire). This ensures both you and the lender are protected.