When cash is tight and emergencies arise, many borrowers look for quick financing options. Logbook loans—loans secured against a vehicle’s registration (the “logbook”)—are one of those options gaining popularity in Kenya and elsewhere. But are they a good deal, or a financial pitfall in disguise? In this post, we’ll dig deep into how logbook loans work, their advantages and risks, regulatory issues, alternatives, and things to watch out for—so that anyone considering such a loan can make a more informed decision.

What Exactly Is a Logbook Loan?

At its core, a logbook loan is a secured loan in which your vehicle’s registration certificate (logbook) is used as collateral. You lend to the borrower the right to hold “security interest” in your car until the loan is repaid. You typically retain possession and use of the vehicle (you keep driving it), but the lender may take the logbook or register joint ownership until the debt is cleared.

In Kenya, many logbook loan providers (banks, nonbank institutions, microfinance firms) require that:

- You are the registered owner (or have rights) over the vehicle

- You supply the original logbook

- You provide proof of income, identity, and sometimes bank statements and insurance

- The car is comprehensively insured (or upgraded to that)

- The lender conducts valuation of the vehicle to determine how much they can lend (often a fraction of its “forced sale value”)

Loan amounts are often some percentage of the vehicle’s assessed value (for example, 50–80 %) depending on the lender and how risky they view the deal.

Repayment periods vary—some are short (a few months), others longer (up to 24–36 months, or sometimes more in special cases).

If you default, the lender often has the legal right to repossess and eventually sell the vehicle to recover the outstanding debt (after giving you notice).

Thus, a logbook loan is somewhere between a personal loan and an asset-backed loan—the risk is lower for the lender (because they have collateral), but higher for the borrower (since your car is at stake).

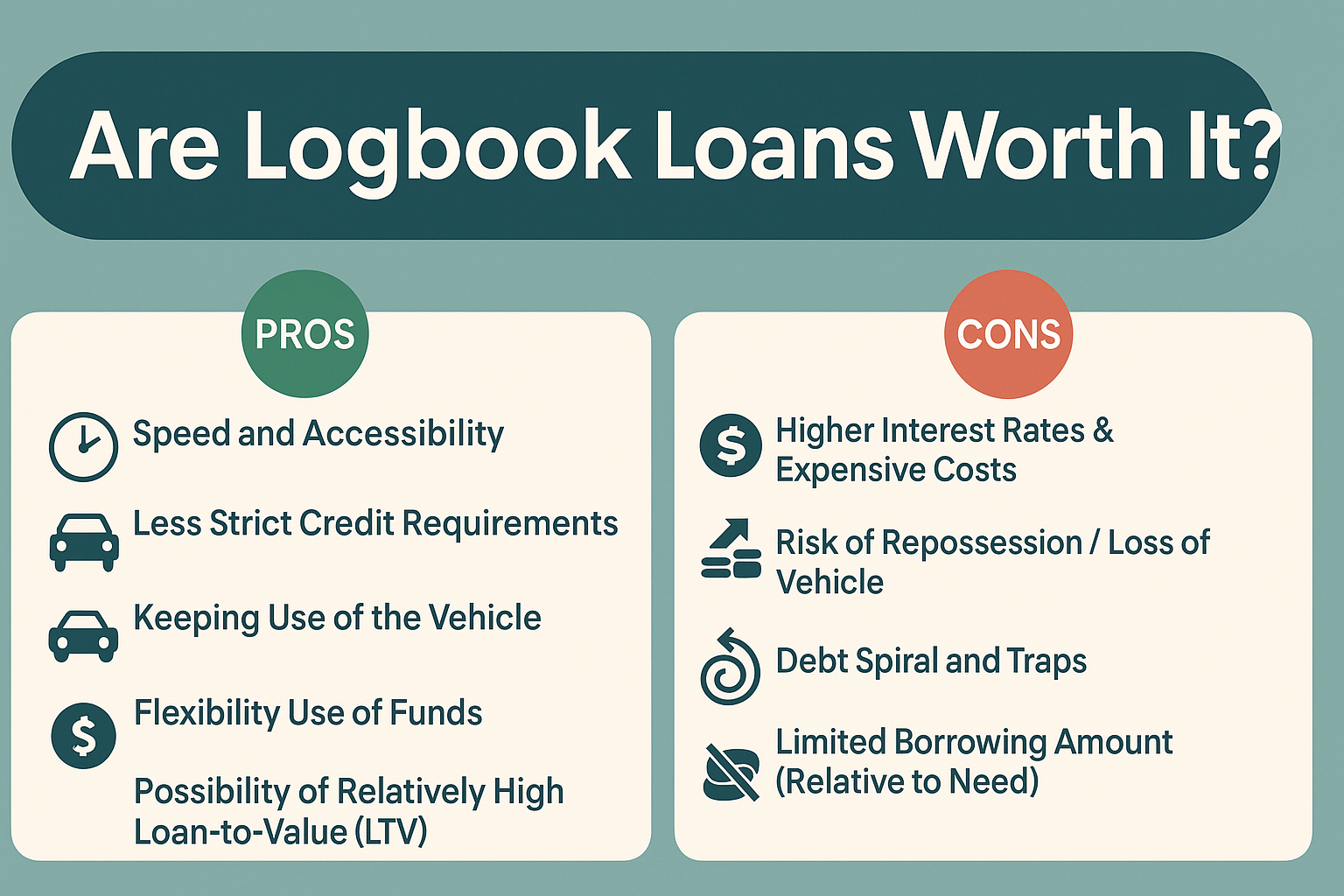

Pros of Logbook Loans

When weighing whether a logbook loan is “worth it,” we must first consider the virtues that make them appeal, especially in tight financial circumstances.

1. Speed and Accessibility

One of the biggest selling points is how fast you can get the funds. Many logbook loan providers tout same-day or within-hours disbursement once the required documentation and vehicle valuation are done.

Compared to traditional bank loans (which may require lengthy processing, credit checks, collateral, many documents, and longer wait), a logbook loan is often more convenient when cash is urgently needed.

2. Less Strict Credit Requirements

Because the loan is secured by your vehicle, some lenders place less emphasis on your credit history or credit score. This means that even if you have poor credit, you might still qualify if your vehicle’s value is acceptable and you satisfy other criteria.

3. Keeping Use of the Vehicle

Unlike a scheme where you might have to hand over the car or stop using it, many logbook loans allow you to continue using your vehicle while repaying the loan—so long as you keep up with repayments and insurance, etc.

This is a crucial appeal: you don’t lose mobility or the ability to use your car for business or transport.

4. Flexible Use of Funds

Logbook loan proceeds often aren’t restricted in how you use them—you can use them for emergencies, business working capital, school fees, medical bills, debt consolidation, etc.

5. Possibility of Relatively High Loan-to-Value (LTV)

Some lenders offer relatively high percentages of the vehicle’s value, particularly for more desirable cars or ones in good condition. For example, some institutions claim up to 80 % LTV on certain vehicles.

Also, lenders may allow combining multiple vehicles (if you own a fleet) to increase borrowing power.

Cons and Risks of Logbook Loans

As with most financial tools, the benefits come with significant tradeoffs. Before you commit, you should carefully weigh the downsides.

1. Higher Interest Rates & Expensive Costs

Because these loans are riskier (to borrowers) and more operationally intensive for lenders (vehicle valuation, monitoring, enforcement costs), interest rates tend to be much higher than conventional unsecured personal loans or bank loans. In Kenya, some logbook loan interest rates range between 1.6 % to even 10 % per month (or more for riskier borrowers) depending on the lender and terms.

These interest payments can quickly balloon, making the effective annual cost extremely high.

Moreover, additional fees often accompany these loans:

- Processing fees

- Vehicle valuation fees

- Logbook search, registration / discharge fees (NTSA or equivalent)

- Legal costs

- Car tracking / GPS device installation

- Upgrades or forced comprehensive insurance premiums

- Early repayment penalties

Sometimes fees or deductions are hidden or unclear, meaning borrowers may not get the full expected cash or may find the repayment burden (interest + fees) steeper than anticipated.

2. Risk of Repossession / Loss of Vehicle

The biggest risk: if you default on repayments—or fail to renegotiate in time—the lender typically has the right to repossess and sell your vehicle to recover the amount owed. This can leave you not only without cash, but without your car, which might have utility or revenue value (for example if you use it for business).

Lenders may also impose “grace periods,” demand notices, or auction processes which may not always favor you.

3. Debt Spiral and Traps

Because these loans can carry high rates, some borrowers may struggle with repayments and seek to roll over or re-finance (a “buyoff” logbook loan) just to cover interest. That can lead to compounding debt, growing balances, and increased vulnerability.

Some lenders may engage in aggressive collection practices or seize your vehicle even when the outstanding debt is modest relative to the vehicle value (especially if contract terms are skewed in their favor).

4. Limited Borrowing Amount (Relative to Need)

While a logbook loan may permit borrowing a high percentage of vehicle value, its absolute amount is still limited by the car’s value. For very large expenses (e.g. building investment, business scale-up), the vehicle security might not suffice. Traditional unsecured or business loans may offer more flexibility in scale.

5. Regulatory / Legal Uncertainty

In Kenya and many markets, logbook loans and asset-backed loans sometimes operate in less regulated spaces compared to deposit-taking banks or standard lending products. This can expose borrowers to less protection, more aggressive terms, or unclear dispute resolution.

New lending rules and better regulation may change the landscape, but until those are fully enforced, gaps remain.

6. Hidden Terms, Fine Print, and Transparency Issues

Many borrowers report that the “headline interest rate” given is only part of the story. Hidden fees, unclear escalation clauses, trackers, default interest penalties, or ambiguous terms may bring surprises.

Some lenders may deduct certain fees from the loan amount (reducing how much you actually receive) or embed costs in the interest. Such practices reduce transparency and fairness.

7. Effects on Credit & Future Borrowing

If you miss payments or default, your credit record may suffer (if connected to credit-reference bureaus), which may hamper your ability to borrow later.

Also, lenders may be reluctant to re-finance you later or provide favorable terms if your track record shows risks.

Is It “Worth It”? A Balanced Verdict

So, given these pros and cons, when might a logbook loan actually be worth it, and when might it be folly?

When It Might Be Worth It

A logbook loan can be a reasonable option when:

- You have an urgent or emergency cash need (medical bills, school fees, sudden business liquidity shortfall) and alternative sources are not available.

- The loan period is short, and you can afford repayments without high risk of default.

- The lender is reputable, transparent, and allows you to see all fees, penalties, and worst-case scenarios up front.

- The value of the vehicle is sufficient and relatively stable (so that even with high interest, the collateral has cushion).

- You have reasonably stable income projections, so you are confident in your ability to service the debt.

- You use the loan for income-generating or high-return purposes (e.g. business investment) rather than consumption, so that the benefit outweighs the cost.

- You plan early repayment or refinancing under favorable terms if things turn out better than expected.

In such cases, the speed and liquidity access might justify the cost, especially if handled carefully.

When It Likely Isn’t Worth It

A logbook loan is probably a bad idea if:

- The interest rates and fees are astronomical or opaque.

- Your projected cash flow is uncertain or marginal—meaning even a small shock or delay could trigger default.

- The loan is large or for a long term, magnifying interest and exposing you to longer risk periods.

- You have alternative borrowing options (e.g. personal loans, family, savings, more conventional credit) that carry lower costs or risks.

- You cannot absorb the loss of the vehicle—if repossession would cripple your life or business.

- You find a lender with poor reputation, unclear terms, or historically aggressive collection practices.

- You foresee needing more borrowing later—the negative credit effects or encumbered assets may reduce future flexibility.

In many such scenarios, the downside outweighs the upside, and the logbook loan becomes a trap.

How to Do Due Diligence If You Consider One

If after weighing pros and cons you are leaning toward taking a logbook loan, here are practical steps and checks to minimize risks:

- Shop around and compare offers. Don’t accept the first offer. Compare interest rates, fees, and effective cost.

- Insist on full disclosure. Ask for all fees (processing, valuation, legal, tracking, registration, default penalties). Demand a clear schedule of repayment obligations.

- Check the lender’s reputation and licensing. Are they registered with relevant regulatory bodies (CBK, microfinance authority, etc.)? Look for reviews, complaints, or court cases.

- Understand default procedures. Ask: what is the grace period, how will repossession happen, how much notice must they give, how will they sell the vehicle, and what happens if sale proceeds exceed or fall short of debt.

- Confirm your vehicle’s valuation is fair. Get an independent sense of your car’s market value to verify that the offered LTV is reasonable.

- Negotiate a term you can manage. Don’t overstretch your cash flow. Better to borrow less and repay more comfortably.

- Plan an exit or contingency. In case cash flow weakens, try to have buffer, secondary income, or plan to refinance to avoid default.

- Keep communication open with the lender. If you foresee difficulty meeting a payment, contact them proactively to renegotiate or restructure—not wait until default.

- Document everything. Keep all contracts, disclosures, payment receipts, and communications in writing.

- Watch for hidden “bait-and-switch” tactics. Sometimes a lender advertises low monthly rates but adds compounding default rates or escalators.

By being vigilant and negotiating proactively, you reduce the chance of unpleasant surprises.

Alternative Financing Options You Should Consider

Before you jump into a logbook loan, consider whether one of these alternatives might be safer or cheaper:

- Personal or unsecured loans from banks or MFIs — if you qualify, they may offer lower interest and regulated protection.

- Salary check-off / payroll loans — repayment is deducted at source, reducing default risk and administrative costs.

- Microfinance loans or group lending — especially for small business owners or community groups.

- Peer-to-peer lending platforms — may allow you to tap individual lenders at competitive rates.

- Secured loans using other assets — e.g. property or other investments, if available and less risky.

- Refinancing or renegotiation of existing debt — to free up cash flow.

- Liquidating non-productive assets or reducing discretionary expenses — to raise cash without incurring debt.

- Short-term family or social network loans — though these carry relational risks, not financial ones.

Choosing among alternatives comes down to cost, speed, risk, and flexibility. In many cases, a milder, lower-cost alternative might be preferable.

Special Considerations in the Kenyan Context

It helps to understand how the Kenyan lending environment and regulatory posture affect logbook loans.

- Interest rate environment and tight margins. Because Kenya’s financial sector has high risk premiums, loans to individuals (especially those without pristine credit) tend to carry higher spreads.

- Fees and regulatory obligations. Many Kenyan logbook lenders impose valuation, NTSA registration/discharge, tracking device, and legal fees. These can materially raise the effective cost.

- Emerging regulation. Some lenders note that Kenya’s new lending rules (e.g. from CBK) are changing how logbook loans must be offered, with more transparency requirements and consumer protection.

- Reputational risk of shady lenders. Because some logbook lenders have aggressive practices or opaque terms, the onus is heavier on the borrower to vet the lender.

- Volatility of vehicle resale values. In Kenya, depreciation, maintenance cost, or parts scarcity may affect valuation over time, making collateral less stable than assumed.

- Enforcement, repossession, and legal costs. The ease with which lenders repossess vehicles, evict, and legally enforce in Kenya can vary. In some cases, repossession may bypass courts under certain contract clauses or through operational pressure.

- Currency or inflation risk. Over longer terms, inflation, maintenance, fuel, and other costs can erode the affordability of repayments. Borrowers need to maintain margin.

Given these local factors, a logbook loan that seems “cheap” on paper may be much more burdensome in practice. Doing local benchmarking and speaking with people who have taken such loans locally is wise.

A Hypothetical Example

To ground the discussion, here’s a simplified hypothetical:

- Suppose you own a car whose forced sale value is KES 1,500,000 (market estimate).

- A lender offers you a logbook loan at 70 % LTV → you can borrow KES 1,050,000.

- The interest rate is 3 % per month, repayment period 24 months.

- There is a 2 % processing fee (KES 21,000), plus vehicle valuation and legal fees of KES 10,000, plus tracker installation cost of KES 5,000, and you must upgrade comprehensive insurance paying an extra KES 15,000 annually.

- So your actual cash in hand is about KES 1,050,000 – (21,000 + 10,000 + 5,000) = KES 1,014,000.

- Your monthly interest-only cost = 1,050,000 × 3 % = KES 31,500. Over 24 months, interest = KES 756,000, plus principal KES 1,050,000 = total KES 1,806,000. If you pay equal installments, your monthly payment might be ~ (1,806,000 / 24) = ~ KES 75,250 (approx).

- If you miss payments, the lender may repossess your car, sell it for perhaps only KES 1,200,000 (if depressed), and possibly incur legal and auction costs. They might recover part but you could owe more if sale proceeds don’t cover full.

In this scenario, you paid nearly 21 % interest per annum (or more, considering fees) plus you risk losing your car. If your monthly income cannot comfortably absorb KES 75,000 over two years, or if you foresee business/income downturns, this becomes quite burdensome.

On the other hand, if your vehicle is undervalued (say real market is KES 1,800,000), or if you can repay earlier, or negotiate better terms (lower fees, lower rate, or shorter tenure), the burden is mitigated.

This example illustrates the margin for error is narrow—small miscalculations, income shocks, or hidden costs can push you into difficulty.

Tips for Borrowers Considering a Logbook Loan

To maximize chances it’s “worth it,” here are practical tips:

- Start small. Don’t borrow the maximum available; leave buffer for shocks.

- Shorter tenure is safer. The longer the term, the more risk of income volatility, inflation erosion, or maintenance surprises.

- Maintain excellent records and stay current. Avoid default at all cost.

- Build a safety net. Set aside contingency reserves or alternative income so you don’t slip into default.

- Negotiate transparent terms, including default clauses and repossession terms. Insist on clarity about how and when repossession can happen.

- Refinance or buy off the loan if better deals arise. Some lenders offer “buyoff logbook loans” to take over your existing debt with improved terms. But check whether the fees or costs of switching outweigh the benefit.

- Don’t hide the debt. Let family or business partners know of the obligation; don’t treat it as off-books.

- Track the market value of your vehicle. If the vehicle’s value drops significantly, your collateral cushion shrinks, increasing risk.

- Always read the fine print. Highlight escalation clauses, compounding default interest, legal and repossession rights.

- Consider partial payments or negotiation if trouble looms. Lenders may prefer renegotiation over losing collateral.

Final Thoughts

So, are logbook loans “worth it”? The honest answer: sometimes—but only when used judiciously, with full awareness of the costs, risks, and your ability to service the debt.

They are tools—not panaceas. For emergencies, they may provide quick access to capital that other routes can’t match. But they come with steep trade-offs: high interest, risk to your vehicle, often aggressive terms, and the need for rigorous discipline.

If you’re considering one, tread carefully:

- Vet the lender’s reputation

- Understand all costs and clauses

- Borrow only what you can comfortably repay

- Keep options open for renegotiation or refinancing

- Use the funds productively, not frivolously

FAQs: Logbook Loans in Kenya

1) What is a logbook loan and how does it work?

A logbook loan is a secured loan where your vehicle’s logbook is used as collateral. You keep driving the car, but the lender registers an interest against it and can repossess if you default.

2) How much can I borrow against my car?

Amounts typically range from 50% to about 80% of the car’s assessed or forced-sale value. The exact loan-to-value depends on the vehicle’s age, condition, marketability, and your risk profile.

3) What are the common costs besides interest?

Expect processing fees, valuation, legal and NTSA registration/discharge fees, tracking device costs, and potentially higher comprehensive insurance premiums. Some lenders also charge early settlement or restructuring fees.

4) How fast is disbursement?

Once documents and valuation are complete, many lenders can disburse within the same day or 24–48 hours. Delays usually arise from missing documents, pending insurance updates, or slow logbook verification.

5) What happens if I miss a payment?

Most lenders issue reminders and demand notices, then apply penalties or default interest. Continued non-payment can lead to repossession and auction; sale proceeds cover debt and costs, and you may still owe any shortfall.

6) Will a logbook loan affect my credit score?

Yes—timely payments may help, but late payments or defaults are often reported to credit reference bureaus, hurting future borrowing options. Always confirm a lender’s reporting practices before you sign.

7) Are logbook loans advisable for business needs?

They can be viable for short-term, high-return uses like inventory restocking or bridging receivables. For longer-term or low-return uses, the high effective cost can erode profitability and increase default risk.

8) What should I check before signing?

Insist on a full cost breakdown, realistic repayment schedule, clear default and repossession clauses, and fair valuation. Compare multiple lenders, borrow less than the maximum, and ensure you can comfortably service the monthly installment.